Cost of living: Another big rate hike expected as US inflation proves more sticky than forecast | Business News

The annual rate of inflation in the United States fell in August for the second month running – but not by enough to allay concerns about the cost of living in the world’s biggest economy.

Inflation on the consumer prices index measure slipped from 8.5% in July to 8.3% on an annualised basis. Wall Street had been looking for a fall to 8.1%.

The main cause for the decline was lower prices of both petrol and used cars.

However, the price of other items rose, particularly in the services sector.

Month on month, consumer prices actually rose by 0.1%, compared with the decline of 0.1% that had been expected.

And ‘core’ inflation – which measures changes in the costs of goods and services but strips out changes in volatile elements such as food and energy – was also punchier than expected.

Petrol, known as gasoline, in the US fell back sharply in price in August following months of record prices ahead of summer

Core prices rose by 6.3% on a year on year basis – stronger than the 6.1% that the market had been expecting.

The figure all but guarantees that the US Federal Reserve will raise its main policy rate by three quarters of one per cent when its next policy decision is announced on Wednesday next week.

The Fed took its main policy rate, Fed Funds, from the range of 1.5%-1.75% to 2.25%-2.5% last month and an increase taking Fed Funds to 3%-3.25% is now more or less priced in by the market.

Fed Funds stood at just 0%-0.25% at the beginning of the year. Taking the rate to the range of 3%-3.25% next week would be the third consecutive such move.

Markets had begun anticipating such a hike since the end of August when Jay Powell, the Fed’s chairman, gave a speech at a symposium of central bankers at Jackson Hole, in Wyoming, in which he said that the Fed would be prepared to risk a US recession if that was the price that needed to be paid for bringing US inflation under control.

It was seen at the time by many commentators as his ‘Volcker moment’ – a reference to Mr Powell’s predecessor-but-three, the great Paul Volcker, who defeated the rampant inflation that plagued the US economy from the mid-1960s to the early 1980s by taking Fed Funds to a peak of 20% in 1981 and who kept interest rates high in order to do so even during two recessions.

Stock futures plunged on news of the inflation figures.

The Nasdaq – which with its high weighting in tech stocks is most sensitive to interest rate movements – was called more than 2% lower at the open.

At the same time, yields (which rise as bond prices fall) rocketed on US Treasuries, with the yield on two-year US Treasuries (the duration most sensitive to short-term interest rate movements) hitting its highest level since 2007.

The yield on the 10-year US Treasury bond had been 3.3% immediately before the stronger than expected inflation numbers hit the screens. It has been trading at more than 3.44% – its highest level since mid-June.

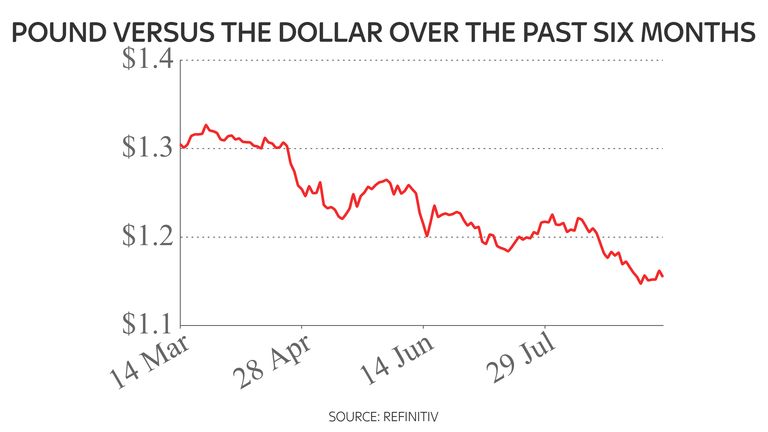

The figures also sparked a sharp rally in the US dollar. The dollar index, which measured the value of the greenback against a basket of international currencies, surged from 107.7 immediately before the release to north of 109 – an increase of more than 1% on the session.

The greenback rose by more than 1% against the euro and by more than 1.25% against the pound.

Recent Posts

- Fred Olsen Cruise Lines ship makes Newcastle debut

- Agent Diary: Wildlife experiences are a big draw – be sure to sell only the ethical ones

- Virgin Atlantic plans electric air taxi service for UK

- Algarve ranks as cheapest destination in holiday money barometer

- Why you need to visit the Boyne Valley on your next Ireland trip

Recent Comments