CEE Market Beat H1 2024

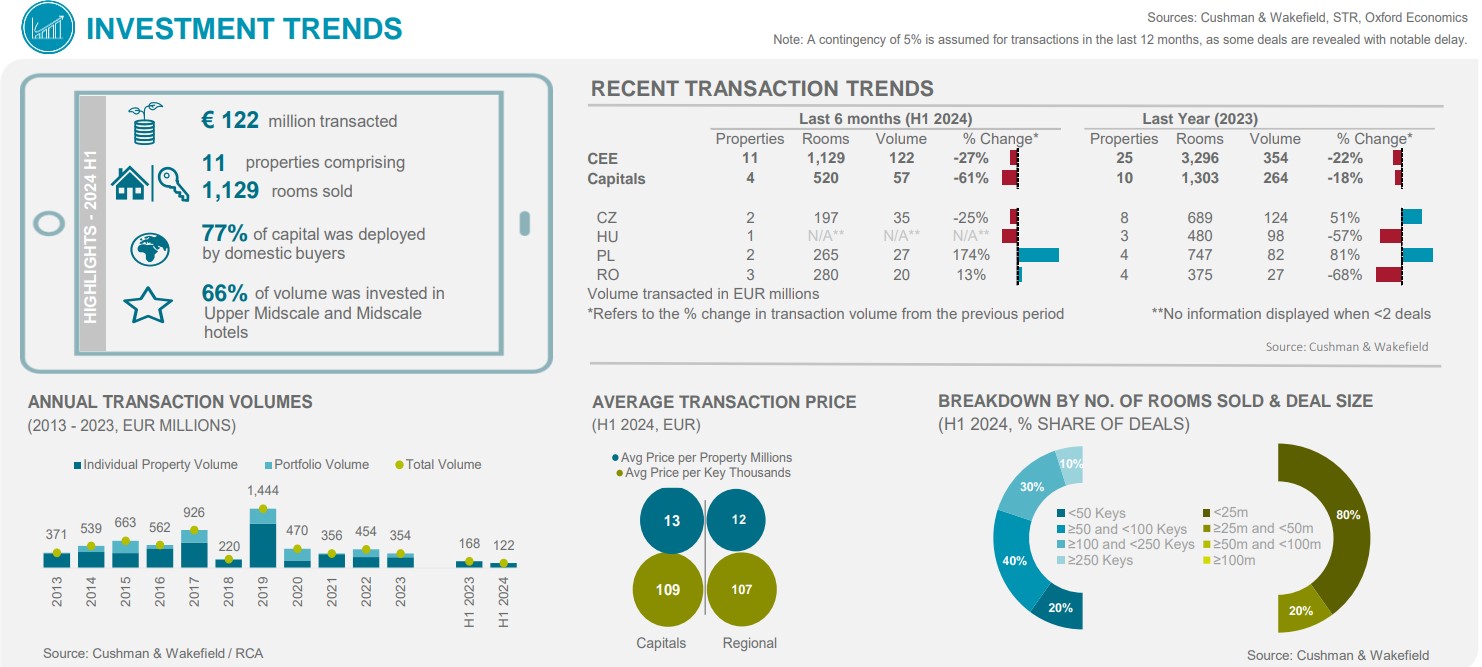

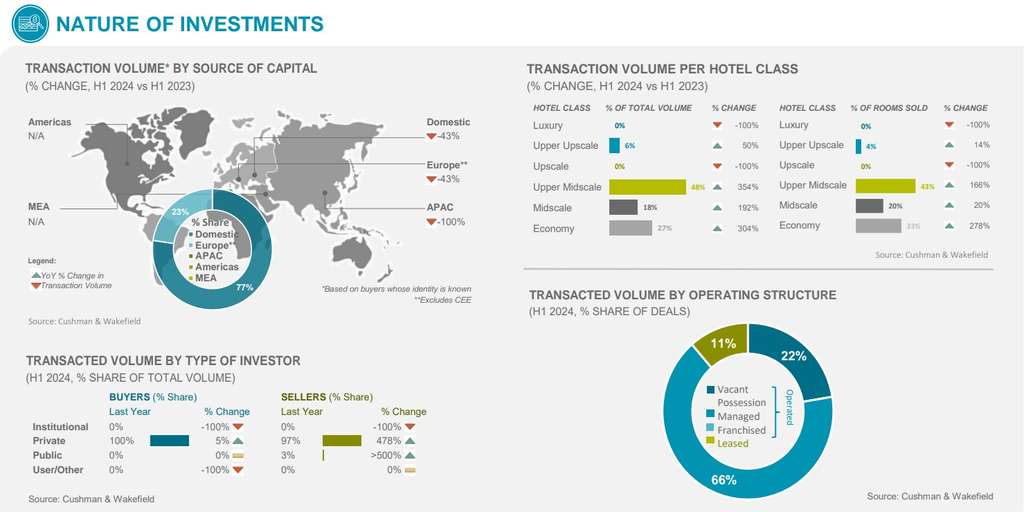

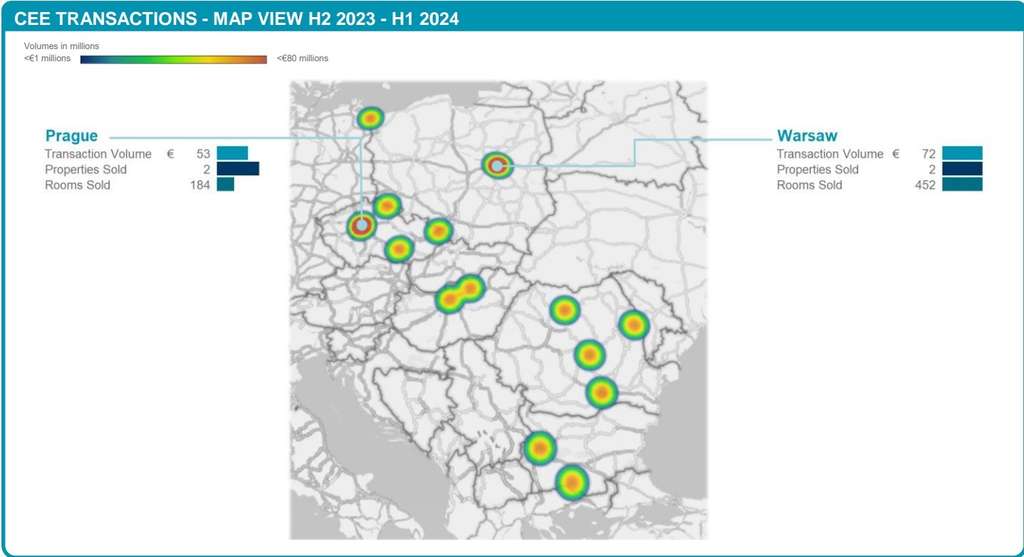

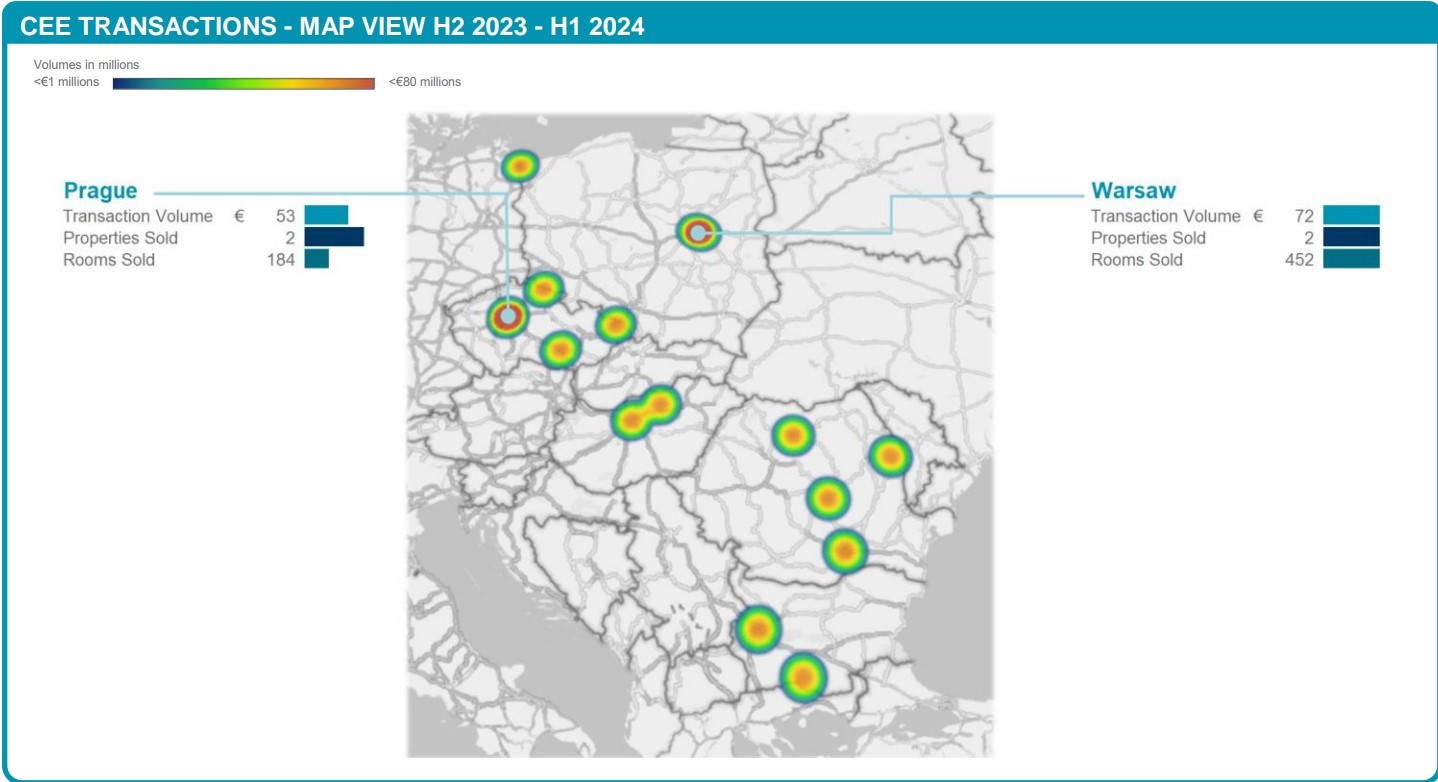

Investment Trends

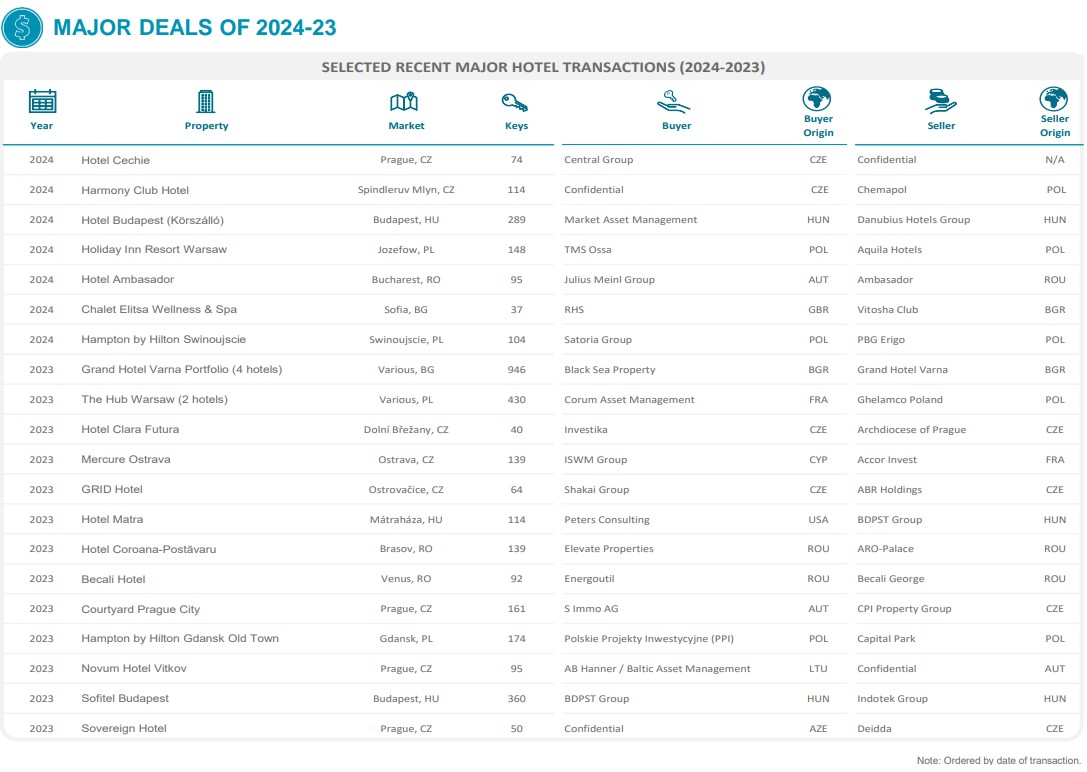

Transaction volume reached €122M in the first half of 2024, 27% less than in H1 2023. This was primarily due to the lack of hotel assets for sale in the CEE region, geopolitical uncertainty, and the high cost of financing. However, this has changed in recent months. Several properties are in various stages of disposition, and this, combined with continued performance growth, improved access to debt, and rising investor interest, is expected to boost volumes in the next 12 months.

Prime Yields

After a notable decompression in 2023, yields remained generally stable in the first half of 2024, with values further supported by growing income. With the ECB’s interest

rate cut in June and growing liquidity in the debt markets, we expect to see further stabilization in 2024 and gradual yield sharpening for prime assets as we progress into

2025.

Market Performance

In YTD June 2024, the RevPAR in the CEE-6 capitals increased by 8.0% compared to H1 2023. This was driven by a 4.2% rise in ADR, with the strongest gains recorded in Prague, Bucharest, and Warsaw. Hotel occupancy reached 67% in H1 2024, 3.6% more than last year, albeit below the pre-pandemic levels across all cites except in Warsaw. Looking ahead, ADR growth is expected to moderate, while occupancy rates are projected to continue their recovery

Supply Outlook

During 2024, the room supply in the CEE-6 capitals is expected to increase at a modest CAGR of 1.4%, translating to the addition of approximately 1,500 rooms. Looking ahead to 2024-2026, the supply is expected to see a moderate 3.2% increase, with new openings such as W Hotel Prague (2024), Puro Warszawa Canaletta (2024), Fairmont Golden Prague (2025) and SO by Sofitel Budapest Chain Bridge (2025). Developers have started to explore office to hotel conversions.

Demand Outlook

In the first half of 2024, the capitals of the CEE-6 region experienced a 0.6% increase in demand compared to the first half of 2019, despite a 7.7% increase in supply over the same period. This trend is driven by the impressive recovery of demand in Warsaw, c. 17%. The return of MICE and corporate demand is expected to drive further growth, but the geopolitical concerns due to the war in Ukraine remain the key challenge.

View source

Recent Posts

- Your Stories: Travelosophers’ Gareth Harding looks back at his career in travel

- Baha Mar Unveils Expansion Plans With New Beachfront Resort And Residences

- Why Uber isn’t buying Expedia, but I still think Amazon should

- Agent Diary: Isn’t it time travel was regulated with a proper qualification?

- TROO Hospitality announces arrival in Central London with iconic Corus Hyde Park hotel

Recent Comments