How Spanish hospitality companies can overcome the staff-shortage challenge

Spain’s economy is more dependent on tourism income than most other European countries. Before the COVID-19 pandemic, the Spanish tourism sector was worth €155 billion, or 14.3 percent of national GDP, and accounted for nearly 15 percent of total jobs in the country. 1 And in some communities, tourism contributes to over 20 percent of all economic activity.

The pandemic knocked Spain’s economy—especially the tourism sector. Spain’s hospitality sector is showing signs of recovery; however, this recovery is hindered by a staff shortage. The high levels of layoffs and furloughs during the pandemic caused talent leakage to other sectors, which is now threatening the hospitality industry’s operational stability and quality. The sector would benefit from a holistic education strategy and more opportunities for training in hospitality; however, training is currently lacking.

Given the importance of tourism in the country’s economy, Spain’s hospitality sector will need to address the current labor shortage to maintain the quality of its tourism services and remain competitive. Doing so will help the industry cultivate the talent it needs for the future. Re-thinking and prioritizing talent acquisition, (re-) training, and retention are critical in this regard.

This article outlines the current Spanish hospitality landscape, and the effects that COVID-19 restrictions had on the sector. It also draws on five key global talent acquisition trends that could help the sector address the current labor shortage and ensure that it has sufficient and well-trained talent for the future.

Spain’s hospitality sector was hit hard by the pandemic

In April 2022, Spain recorded 20 million workers—breaking its employment record. Today, the country has 500,000 more workers than before the pandemic broke out, which suggests that employment has resumed its growth path. 3

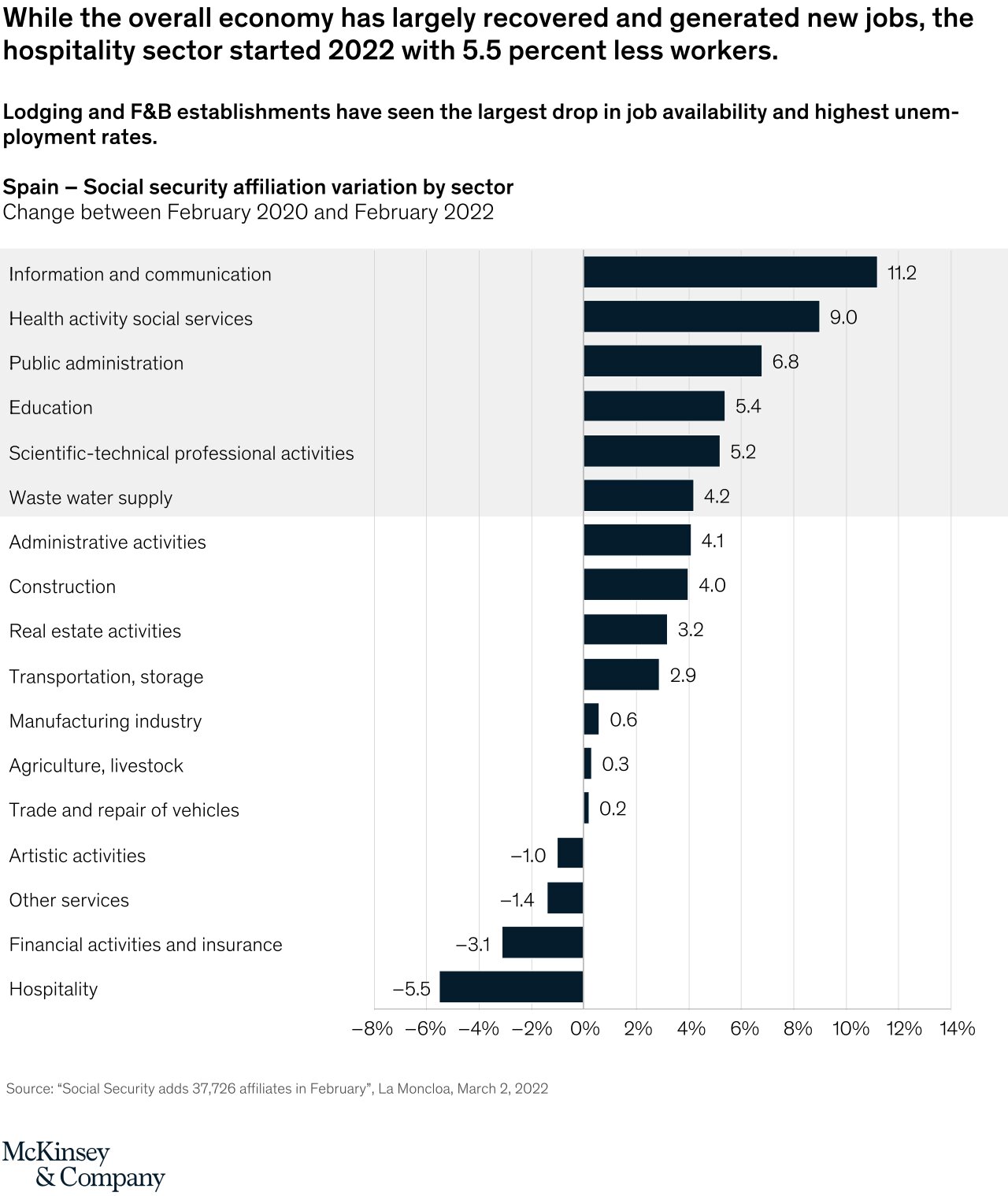

However, the hospitality industry—which usually employs around one in eight workers—is under-resourced, with roughly 73,400 fewer employees than it had in February 2020 (a 5.5 percent fall). Employment in the hotel sector closely follows seasonal peaks in demand but sank to zero with the onset of the pandemic and has since experienced talent leakage to other industries.

Especially impacted are the lodging and food and beverage (F&B) establishments, which have seen the largest drop in job availability and the highest unemployment rates in the sector due to the staff shortage (Exhibit 1).

This staff shortage in hospitality is reflected in the economy. While tourism traditionally represents around 14 percent of the country’s GDP, the sector’s contribution has more than halved from €155 billion in 2019 to €61 billion in 2020. 4 Tourism is showing signs of recovery; however, given the country’s dependence on tourism revenues, the economic impact of COVID-19 is significant (Exhibit 2).

Even as tourism and hotel bookings begin to recover, the staff shortage still poses a significant threat to the industry. 5

The challenge for hospitality lies in re-attracting skilled employees

The tourism sector now faces the challenge of re-attracting employees to the industry as demand returns.

However, the crux of the issue may not lie in the number of workers needed to bridge the shortfall, but in their skills, which are critical for providing high levels of service. The lack of skilled workers in the industry was already a concern pre-pandemic, with the European hotel association, HOTREC, citing this as one of the five most pressing issues facing European hospitality. 6 Employment data only reflect the number of employees, not necessarily their skills, education, or training—so the sector’s talent crunch may be more pronounced than it seems.

Spain may be facing a hospitality talent crunch as there are limited opportunities to gain formal hospitality training. There is no holistic education strategy within the sector, as few Spanish universities provide hospitality training or offer qualifications that provide career paths in the industry. Vocational training (formación profesional dual) is an emerging option for those wishing to pursue a career in hospitality, yet these centers do not have capacity to meet the industry’s needs. It is estimated that the Spanish hospitality industry will need to fill 900,000 jobs by 2030, but currently there are only 50,000 students gaining professional training in hospitality and tourism each year. 7 As such, Spain’s lack of workers who are trained in hospitality may pose a threat to the future of the industry.

Read the full article at McKinsey & Company

Recent Posts

- Baha Mar Unveils Expansion Plans With New Beachfront Resort And Residences

- Why Uber isn’t buying Expedia, but I still think Amazon should

- Agent Diary: Isn’t it time travel was regulated with a proper qualification?

- TROO Hospitality announces arrival in Central London with iconic Corus Hyde Park hotel

- Premier Resorts & Management Opens Renaissance Hotel on Daytona Beach Oceanfront

Recent Comments